Why Does Medicare Continue to Be Secondary to My Health Insurance

How Secondary Insurance Works

What are the Best Medicare Supplemental Plans?

When you have two insurance policies that cover the same kinds of risks, one of them is primary and the other is secondary. For example, suppose you have Medicare along with Medicare Supplement Plan G. Medicare will be your primary health insurance, and the Medigap plan is secondary. If you go to the doctor, Plan G will cover the remainder of the cost that you would otherwise be responsible for paying.

Do I Need A Medicare Supplemental Insurance Plan

It depends on your coverage. Medicare supplemental insurance plans are standardized insurance add-ons regulated by the federal government and issued through private insurance companies. Individual insurance companies set their own premiums for each Medigap option they offer. Medicare supplemental insurance options are labeled with letters A through L.

Each plan includes a list of benefits that every insurance company must offer. That means that no matter which company you purchase your Medigap policy from, you will always have the same coverages and inclusions. This is true for all Medicare enrollees except those who live in Massachusetts, Minnesota or Wisconsin because coverages in these states vary from the standard list of inclusions.

Take a look at whats covered under each Medicare supplemental plan that you can currently purchase.

Understanding The Basics Of Medicare Supplement Insurance

Since its a type of insurance, descriptions of Medicare Supplement policies often contain terminology and stipulations that can be confusing to many shoppers. Weve included this section to help you understand exactly what each plan and company is offering.

Eligibility Medicare Supplement Insurance can only be purchased by people who are covered by Original Medicare: Parts A and B. Seniors with Part C, or Medicare Advantage, can not purchase Medicare Supplement Insurance.

Insurance is PrivateWhile Medicare is a federal program, its important to realize that Medicare Supplement policies are provided to consumers by private insurance companies and not the government. However, both the federal and state governments regulate the plans that are offered. Each insurance company has the ability to decide which plans it wants to offer.

Standardized PlansAll of the plans available are standardized and will offer the same basic benefits, but some companies may offer extra benefits in addition to what is required. Currently, the available plans include A, B, D, G, K, L, M, and N. So while factors like the cost of a plan may vary, Plan A from one company must cover the exact same things as Plan A from any other company. Only Massachusetts, Minnesota, and Wisconsin have standardized plans that are different from the rest of the country.

Read Also: What Is The Medicare Discount Card

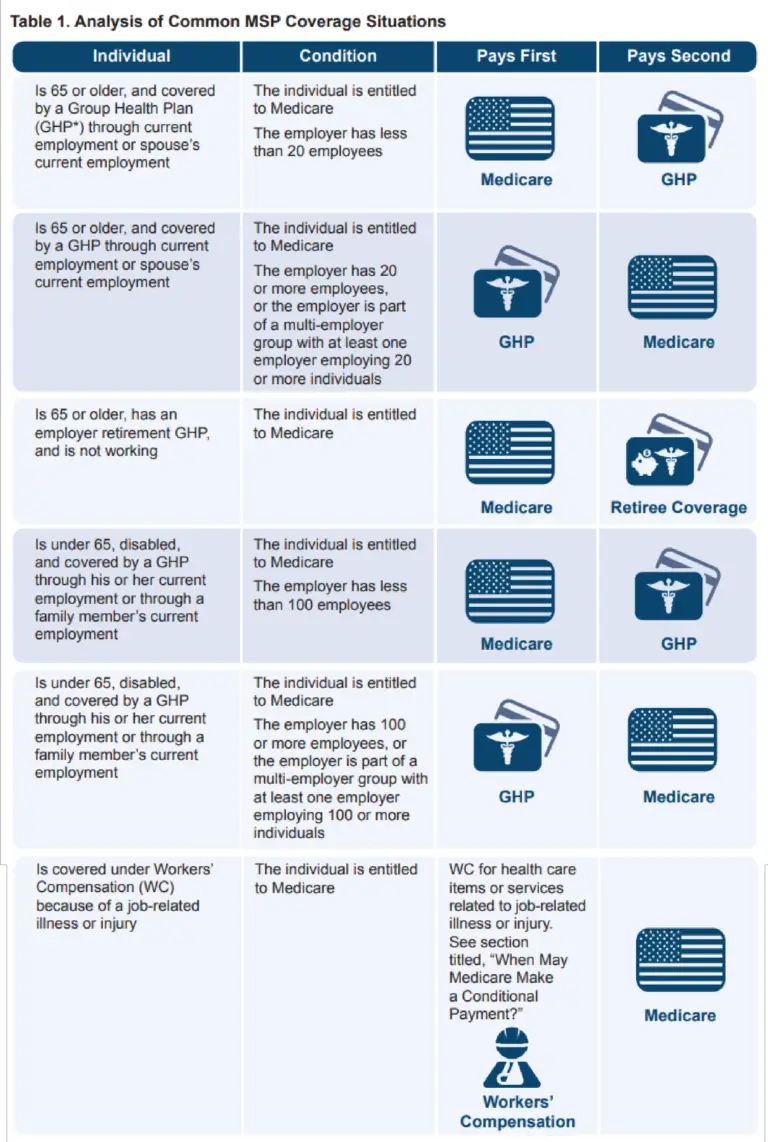

How Medicare Works With Other Insurance

If you have

and other health insurance , each type of coverage is called a "payer." When there's more than one payer, "coordination of benefits" rules decide who pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" to pay. In some rare cases, there may also be a third payer.

Which Companies Sell Medicare Supplement Insurance In Indiana

Companies must be approved by IDOI in order to sell Medicare Supplement policies. All of the companies listed below have been approved by the state. The plans are labeled with a letter, A through J. Not all companies sell all ten plans. Following each company name and phone number, we have listed the Medicare Supplement plans sold by that company based on the following categories:

- Medicare Supplements for Persons 65 and Older

- Medicare Supplements for Persons Under 65 and Disabled

- Medicare SELECT Insurance Companies

Don't Miss: What Is The F Plan For Medicare

Medicare Supplement Plans In Massachusetts

Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan.

-

Coinsurance for Part A services plus 365 additional hospital days

-

Coinsurance and copayments for hospice costs under Part A

-

Coinsurance for medical services under Part B

-

First three pints of blood

Screenshot from "Choosing a Medigap Policy," July 8, 2019.

Additionally, both plans cover state-mandated insurance benefits, such as annual Pap smears and mammograms. A full list of mandated insurance benefits can be seen here. The state government establishes maximum benefit amounts for some of these benefits. You can find complete plan details for 2019, along with plan premiums, on this link.

In addition to the basic benefits and mandated benefits, the Core plan covers 60 days of hospitalization in a mental health facility. It does not cover any deductibles for Medicare Part A or Part B.

Best for: People who can afford their Part B deductible, especially those who do not have a history of mental health hospitalizations and who do not foresee a need for nursing home or inpatient care. Depending on the insurer, premiums for the Core plan can be much lower than the Supplement 1 plan.

Dental Plan: The Mouth

What goes on in your mouth can have an effect on your overall health. Regular dental care is especially important for people with diabetes , who are more prone to gum disease. Dental plans typically cover routine teeth cleanings and preventive care, as well as procedures like fillings and extractions.

Peggy, 38, is a married mom living in Raleigh, NC. A front desk agent at a local hotel, she bought dental insurance from her employer even though the family has medical coverage through her husband Jim. Shes glad she did: Peggy cracked a filling on a popcorn kernel and needs a repair. Since she chose a more comprehensive plan, shell pay only a fraction of the cost to get a new filling.

Within a week, a parent in her toddlers play group gives her some news. Experts now recommend that little ones have their first dental appointment by age 1, or shortly after the first baby tooth comes in. Her 2-year-old son is overdue! Peggy is delighted to discover her plan covers her sons visit.

Also Check: How To Compare Medicare Drug Plans

Anthem Blue Cross Blue Shield

PLUSES

Anthem offers its Medicare supplement customers access to Silver Sneakers at no additional cost in many areas. It also has a robust dental, hearing and vision plan at relatively modest prices.11

MINUSES

The number of available plans is limited to three or four out of 10, so if you want one of the less-popular plans, you wont be able to buy it.12

Because Anthem only operates in a few states, if you move out of its coverage area, your Medicare supplement coverage will be handled by the Blue Cross/Blue Shield company in your area, which could mean some changes that you dont like. Your costs may also be affected.13

How Does Dual Coverage Work

Best Medicare Supplement Plans (2022)

Since dual coverage is just another term for having secondary dental benefits, it works just as weve already discussed. However, a quick step-by-step review might help clarify a fairly complex topic. While theres a lot more to it, using secondary insurance can be broken down into three steps:

Here are some simple answers to common questions on secondary dental insurance.

You May Like: Does Medicare Plan F Cover Acupuncture

What Do Medicare Supplement Plans Cover

All 10 Medicare Supplement plans offer the following core set of benefits:

- 100 percent of Your Part A Coinsurance There is also an additional 365 days of coverage after your Part A benefits are exhausted.

- Part B Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Your First Three Pints of Blood Each Year Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Part A Hospice Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

Some plans build on these baseline benefits and cover other out-of-pocket costs, such as your Part A and Part B deductibles, Part A skilled nursing facility coinsurance, and Part B excess charges. A few plans even offer a foreign travel emergency benefit that helps cover medical costs if you need care while traveling outside the United States.

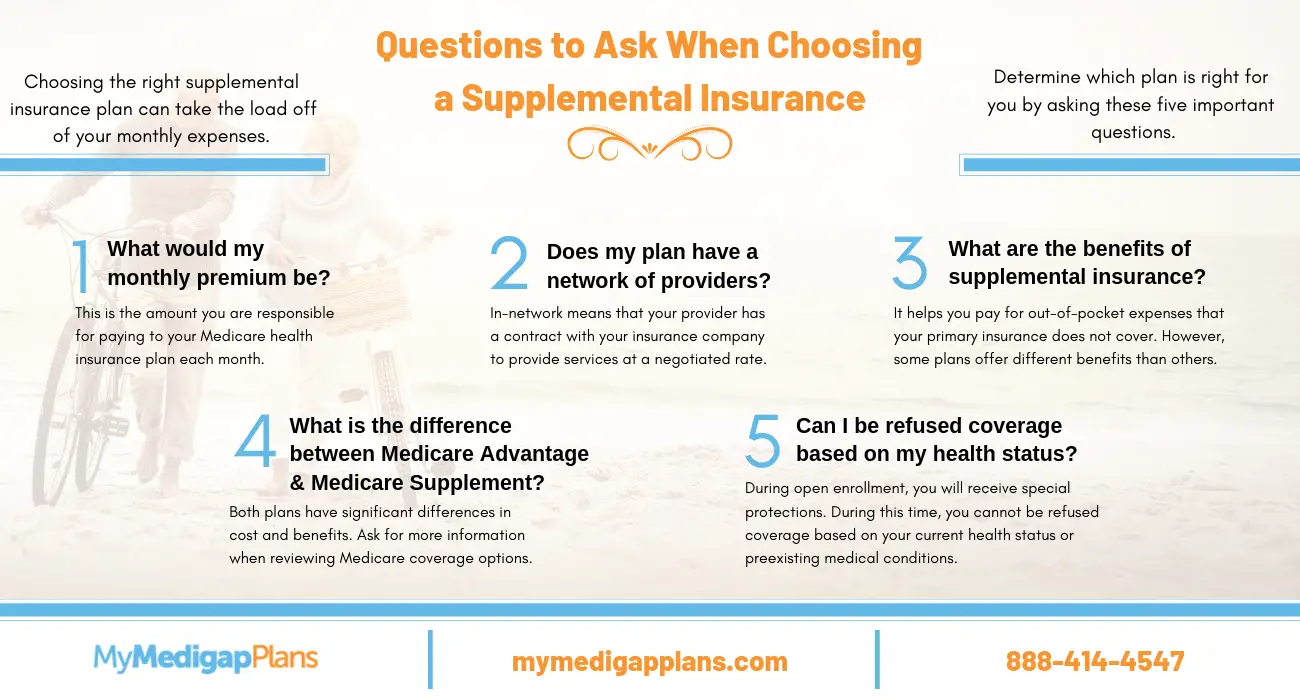

Is Supplemental Insurance Worth It

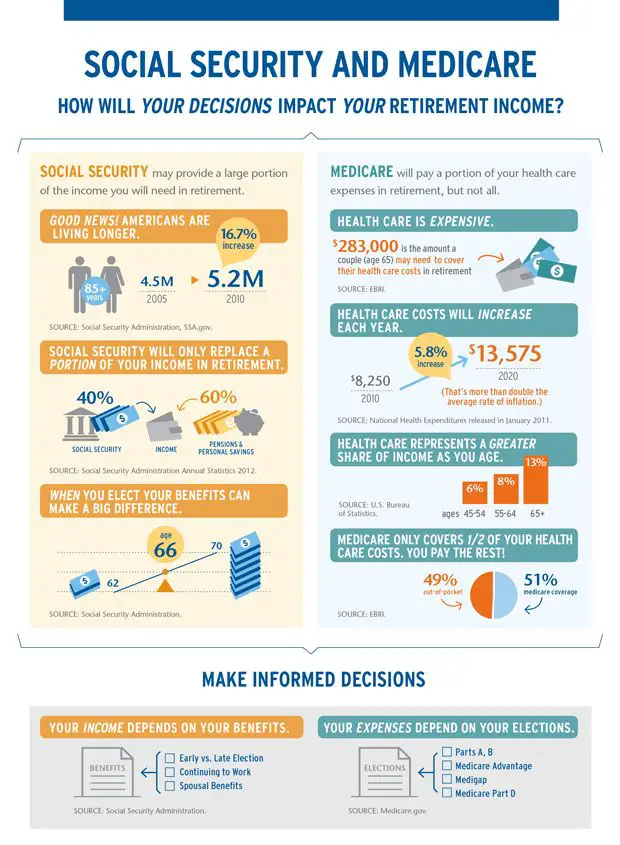

It depends. Most seniors do supplement Medicare in some way. Those that dont have access to group health coverage will often invest in a Medigap policy to supplement Original Medicare or Medicare Advantage plan in lieu of Original Medicare. The right choice between these two really hinges on what you need. Medicare Advantage has lower premiums, which can keep costs down for healthy seniors. Medigap has higher premiums than Medicare Advantage plans. But those higher premiums may be worth it when:

- You have health issues that require frequent doctor visits.

- You travel frequently out of your home state or out of the country.

- You prefer to choose your own doctors and specialists, rather than seeing only the healthcare providers that are in your plans network.

Also Check: What Is The Difference Between Medicare Supplemental And Advantage Plans

What Happens When You Max Out Your Dental Insurance

Your insurance policy and company determine that, so checking with them may be the only way to know for sure what happens when you max out your dental coverage. Usually, it means that your policy will no longer contribute to expenses.

Maximums may not apply to basics like preventive care. However, treatment for gum disease or even oral surgery can run the total up quickly. A secondary plan may continue to contribute even if the primary plan is maxed. Also, note that some services may have separate maximums available after waiting periods.

What Is Medigap Plan K What You Need To Know

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere's how we make money.

Medigap Plan K is a Medicare Supplement Insurance plan that covers certain out-of-pocket expenses associated with Medicare Part A and Part B coverage. Plan K differs from most other Medigap plan options because it pays only part of the cost of the services it covers, but that reduced coverage also helps keep premium costs down.

Read Also: Do I Have To Apply For Medicare Every Year

How Does Medicare Supplement Insurance Work

Medicare Supplement Insurance helps you pay for the gaps in Medicare coverage. Once Medicare pays its share of the services you are receiving, Medigap will help you pay the rest.

If your Part B policy says it covers 80% of a doctors visit, Medicare will pay that. Medigap kicks in for the other 20%. Lets suppose your Medigap Plan says that it will pay 75% of your Part B coinsurance. That means you will only pay one-quarter of the total cost of your doctors visit.

Heres an example with numbers: if the doctors visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5. If you didnt have Medigap, you would be responsible for paying the entire $20 that were left over after Medicare paid its share.

Depending on the plan you select, Medicare Supplement Insurance can help you pay for the Part A and Part B deductibles. It can also help you pay for medical expenses if you have a medical emergency outside of the United States.

Can You Be Covered By Two Health Insurance Plans

Yes, you can be covered by two health insurance plans.

In some cases, each member of a couple might have health insurance through their employer. Children up to the age of 26 also might have coverage through their employer and their parents.

It is also possible for others such as members of the military and those who are on Medicare but are still working to have more than one form of coverage.

However, being covered by two plans is the exception to the rule. If youre covered by one solid employer-based health insurance plan, thats usually sufficient for most people, Mordo says.

Youre really not getting any benefit by being covered by two different employer-based plans, he says.

Don't Miss: How Do I Get A Replacement Medicare Card Online

What Are The Top Medicare Supplement Plans

Medicare Supplement plans pay secondary, meaning after Original Medicare pays its portion. Each Medigap plan is identified by a different letter, A through N.

There are 12 Medicare Supplement plans available to those enrolled in Original Medicare 10 lettered plans and two high deductible plans. Across all carriers, benefits from the same letter plan are identical.

However, the top three Medicare Supplement plans are those with the highest levels of benefits. These plans are popular because of their coverage, low out-of-pocket costs, availability, and overall client satisfaction.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Below we review the top three Medicare Supplement plans and how you can benefit from their coverage.

What It Means To Pay Primary/secondary

Which Medicare Supplemental Plan G is Best?

- The insurance that pays first pays up to the limits of its coverage.

- The one that pays second only pays if there are costs the primary insurer didn't cover.

- The secondary payer may not pay all the remaining costs.

- If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

If the insurance company doesn't pay the

promptly , your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should've made.

Also Check: How To Disenroll From A Medicare Advantage Plan

What Is Dual Dental Coverage

Dual dental coverage doesnt refer to separate types of dental insurance. Its just another way of talking about secondary dental insurance. When you have a second dental plan that will provide coverage, then you have dual coverage. All the points weve already covered regarding any waiting period, cost of preventive care services, major dental care, and so forth still apply .

What We Specialize In

Our agency represents over 30+ insurance carriers. We are licensed to sell Medigap plans, Medicare Advantage plans, Part D prescription drug plans, dental/vision/hearing plans, and cancer policies. If you ever want to change your policy or switch plans, all you have to do is pick up the phone and give us a call. Our team is always available to evaluate your situation and provide recommendations.

Read Also: How To Prevent Medicare Fraud

Who Are The Established Top Medicare Supplement Companies

AARP / United Health Group

AARP/United Health Group has the largest number of Medicare Supplement customers in the country, covering 43 million people in all 50 states and most U.S. territories.3 AARP licenses its name to insurer UnitedHealthCare, which helps make these policies so popular.

Ratings: The company has an A- or Excellent financial strength rating from insurance credit rating agency AM Best4 and satisfactory quality ratings from the National Committee for Quality Assurance .5

Special benefits: Enrollees enjoy gym memberships, nurse helpline, and dental, vision, and hearing discounts.6

Mutual of Omaha

Mutual of Omaha, the second-largest Medicare supplement insurer, launched its Medicare supplement insurance program in 1966, which is the year the Medicare program began. The companys Medicare supplement plans covered 1.4 million people in 2020.7

Ratings: Mutual of Omaha enjoys an A+ financial rating from AM Best, the best available.8

Special benefits: As a mutual company, the enrollees own the company. That means youll get a share of the profits annually. Other benefits include a discount of up to 12% for people who live with someone older than age 60, whether they are a Mutual of Omaha customer or not.9 Plans in some, but not all areas, offer dental and vision assistance, exercise benefits, and a nurse hotline.

CVS / Aetna

Ratings: It has an AM Best rating of A or excellent11 and NCQA gives the company satisfactory quality ratings.12

Health Care Service Corp.

Best Medicare Supplement Plans For 2022

Plan G is the most comprehensive Medigap policy in 2022, but it's also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Find Cheap Medicare Plans in Your Area

Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. The best Medicare Supplement plan for you will depend on your health and budget.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST

Recommended Reading: Does Medicare Pay For Crowns

What's The Best Secondary Health Insurance For Pregnancy

You can reduce the cost of your pregnancy by signing up for supplemental health insurance for pregnant women. Options include short-term disability insurance and a maternity leave plan, which can help replace the lost income. Plus, a hospital indemnity plan can reduce your out-of-pocket hospital costs by giving you a direct cash payment for covered situations. The best policy for you will depend on your specific needs.

Many secondary insurance plans consider a pregnancy to be a preexisting condition and will not provide coverage for pregnancies that are known before a policy begins. There could also be a waiting period that prevents pregnancy coverage in the first several months of a policy.

Source: https://www.medicaretalk.net/what-is-the-best-secondary-insurance-with-medicare/

0 Response to "Why Does Medicare Continue to Be Secondary to My Health Insurance"

Post a Comment